Table of Content

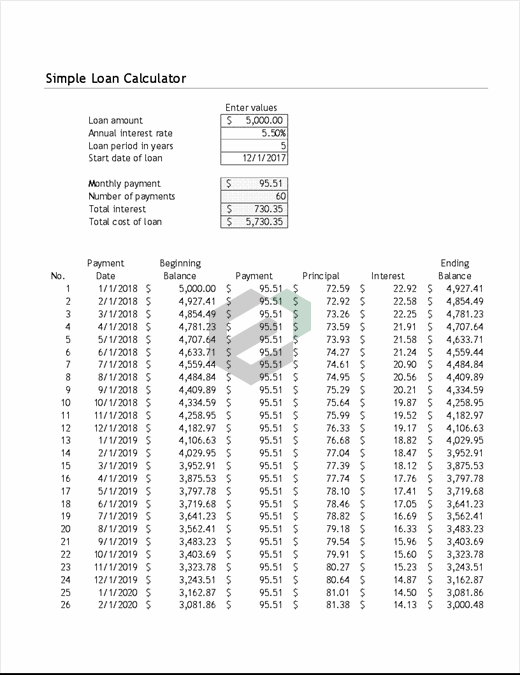

It also helps in finding out savings in terms of paying off the debt early. With EMI repayments, consumers are better able to handle their monthly finances. Banks also offer 'Part prepayments' and 'Full pre-closures' on your loans, which allow you to use the bulk of the sum you may receive during the loan repayment period. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount and determines the portion of one's payment going to interest. Having such knowledge gives the borrower a better idea of how each payment affects a loan.

Obligation to the bank would be terminated only if the full amount in the loan account becomes Zero, if any, on payment of the residual amount. A loan is any money borrowed by an individual or another party. The lender — usually a company, financial institution, or government — provides the borrower with a sum of money. In return, the borrower agrees to a series of terms covering all financial costs, interest, maturity dates and other terms and conditions. In certain situations, the lender may often require collateral to protect the loan and ensure its repayment. Please find the same as an attachment in the mail id shared by you.

What is the EMI structure for an Rs.25 lakhs SBI Home Loan?

Obtaining a Home Loan statement from SBI is a very simple process. You are just one step away from using Home Loan related services. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc.

This table shows the exact amount of interest and principal that is deducted from your loan amount for each EMI you pay. Yes, you can withdraw the amount from your maxgain account any time. By parking money in your OD account, you will be reducing the book balance , by doing so, your total interest outgo will get reduced. However, each month, the principal repaid and interest payment proportion will be different in every EMI.

How is the SBI Home Loan Statement useful?

If so, then for a certain period you will be paying only interest on the entire outstanding amount, after which full EMI payments will start. If that’s not the case, then please contact your bank for more clarification on this. The home loan EMI calculator SBI on our website is available free-of-cost.

Interest rate- the cost for taking a loan is the interest rate paid on it. The higher the interest rate, the higher will be the cost of the loan and the higher the EMI amount. Thus, before taking the SBI Home Loan, make sure to compare various interests so that the borrower can get a loan at a lower EMI. The calculation and comparison of EMI can be done with the SBI Home Loan EMI Calculator.

Savings Accounts

You should choose tenure that you are comfortable with, keeping in mind the total payout every month. Loan tenure- this tenure is the period within which the borrower needs to pay back the loan amount. The longer the tenure of the loan, the lesser will be the EMI amount.

By paying half of the monthly amount every two weeks, that person can save nearly $30,000 over the life of the loan. One way to pay off a mortgage faster is to make small additional payments each month. This technique can save borrowers a considerable amount of money. Banks amortize many consumer-facing loans such as home mortgage loans, auto loans, and personal loans.

Currently, the lowest SBI Home Loan interest rate is 6.70 percent. Despite these challenges, refinancing can benefit borrowers, but they should weigh the comparison carefully and read any new agreement thoroughly. Submit the form along with a copy of documents, including PAN Card, Aadhaar Card, Passport, etc. Fill in all the necessary details such, as Home Loan Account Number, Applicant’s Date of Birth, Email ID and other contact details as applicable. You need to log in to Personal Banking for accessing and downloading the Home Loan statement.

If such conditions exist, a bank will usually spell them out in the mortgage agreement. A prepayment is a lump sum payment made in addition to regular mortgage installments. These additional payments reduce the outstanding balance of a mortgage, resulting in a shorter mortgage term. The earlier a borrower makes prepayments, the more it reduces the overall interest paid, typically leading to quicker mortgage repayment. Over time, the balance of the loan falls as the principal repayment gradually increases.

Nonetheless, our mortgage amortization calculator is specially designed for home mortgage loans. SBI home loan EMI calculator, borrowers can calculate their monthly installments before applying. Home loans are long-term and secured financing options available for constructing or purchasing a property. In recent years, home loans have seen a considerable rise, one of the primary factors for which is the Pradhan Mantri Awas Yojana .

CreditMantri was created to help you take charge of your credit health and help you make better borrowing decisions. If you are looking for credit, we will make sure you find it, and ensure that it is the best possible match for you. We enable you to obtain your credit score instantly, online, real time. We get your Credit Score online and provide a free Credit Health Analysis of your Equifax report. Based on the analysis, we help you discover loans and credit cards best suited for your credit profile. We help you understand your Credit Profile, Credit Information Report and know where you stand.